Unveiling the Journey of Revfin: A Perspective from CEO Samir Agarwal

Introduction to Revfin's Origin and CEO's Journey:

Embark on an exploration of Revfin's remarkable story through the lens of its CEO, Samir Agarwal, who shares insights into the journey of forming this innovative organization. The genesis of Revfin traces back to Samir's return from London to India, where he identified challenges in the loan application process, inspiring the creation of a revolutionary financial solution.

Necessity Behind Revfin's Inception:

Samir Agarwal delved into the genesis of Revfin, highlighting the inherent complexities in the traditional loan application process. He observed the cumbersome nature of background checks and the need for extensive paperwork, particularly related to property details. Motivated by a vision to simplify this process, Agarwal conceptualized Revfin as a solution to streamline and democratize access to financial services.

Innovations in Loan Processing:

Revfin's groundbreaking approach introduces a paradigm shift in loan processing. Agarwal emphasized the departure from conventional financial record assessments to a more inclusive method. The organization adopted the avant-garde concept of psychometric analysis, a collaborative effort with IIT Kharagpur, leveraging artificial intelligence. This innovative approach bypasses traditional financial history checks, making loan access more efficient and accessible.

Integration of Artificial Intelligence:

The core of Revfin's success lies in its collaboration with IIT Kharagpur to implement artificial intelligence in the loan application process. The psychometric analysis, a novel concept introduced by Revfin, is designed to simplify the loan approval process. Through this cutting-edge technology, Revfin pioneers a user-friendly application experience that minimizes the bureaucratic hurdles often associated with obtaining loans.

Democratizing Access Through Simplicity

At the heart of Revfin's mission is a commitment to simplicity and accessibility. Agarwal emphasized the user-friendly nature of the psychometric analysis, ensuring that the loan application process is straightforward for individuals from all walks of life. The goal is to empower people by removing the complexities of traditional financial record assessments and providing a seamless pathway to financial assistance.

Application Beyond Conventional Sectors

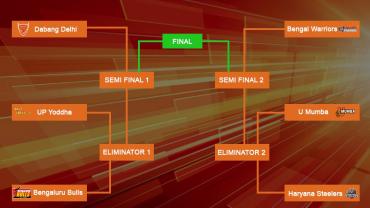

Revfin's visionary approach extends beyond traditional industries, envisioning a future where the benefits of simplified loan processes are accessible to various sectors. Agarwal specifically highlighted the potential for Kabaddi players to leverage this innovative system, allowing them to secure loans with ease. This demonstrates Revfin's commitment to inclusivity and its belief in extending financial opportunities to diverse communities.

Conclusion and Future Prospects

As Revfin continues to redefine the landscape of financial services, Samir Agarwal envisions a future where the organization's innovative solutions reach even greater heights. By combining artificial intelligence, simplicity, and inclusivity, Revfin stands at the forefront of transforming the loan application experience, making financial empowerment a reality for individuals across different sectors. Kabaddi Players can incorporate the process where they can obtain loans from this simple Psychometric analysis. The ease with which where Kabaddi Players obtain loans from Revfin is simple and easy to execute.

Revfin presence spans across 19 states, encompassing 500 cities and a network of 1000 dealerships, positively influencing the lives of 11.2 million individuals. Notably, we have facilitated the financing of 35,000 electric vehicles, which collectively have covered an impressive 775 million eco-friendly kilometers. This initiative has resulted in a substantial reduction of 69,800 tons of CO2 emissions, underlining our commitment to sustainable and environmentally responsible practices.

- 46 views